Regardless of the economy, there will always be people who want to build wealth quickly. For some, buying stocks is the only way they know how to grow their money. However, there are other ways to achieve similar results without taking on so much risk. In fact, there are several methods that can help you make money.

There are a lot of different opinions on the best way to build wealth. Some people think that buying stocks is the only way, while others believe in building businesses from the ground up. However, there is another option – and it’s one that can be a lot faster than buying stocks.

There are many different ways to build wealth. You can inherit money, win the lottery, or get lucky in business. However, most people accumulate wealth slowly over time by saving and investing money. Another option is to build wealth quickly without buying stocks. This can be done by earning more money and spending less, or finding creative ways to make money. Although it’s not easy to amass a fortune quickly, it’s definitely possible. Here are a few tips to get you started.

How to Create Wealth?

There are just two things to get right if you want to build wealth:

- Increase the gap between your earnings and spending.

- Save the difference and watch it increase enormously in the future.

Despite this, the great majority of people never accumulate significant money. Rather than becoming wealthy over time, they simply stay afloat decade after decade, spending as much as they earn. They save a tiny amount of money and rely on the government or a pension to support them when they retire.

How to Make More Money and Save More

It won’t matter if your wealth grows at 6% or 8% per year if you can’t save and invest consistently every month.

Here’s a quick rundown of three strategies to start accumulating significant wealth.

Choose a well-paying job

The Bureau of Labor Statistics maintains a useful database of occupations that may be ranked by median salary. If you click on various occupations, you can see full breakdowns of median income, including pay for different subsets of those professions.

There are over a hundred jobs that pay more than $80,000 a year. Medical doctors, lawyers, actuaries, nurse practitioners, engineers, managers, financiers, and other technical professionals can easily earn six figures.

It’s also necessary to consider the costs of education.

Surgeons and specialized physicians are the highest-paid occupations, but they require a minimum of 12 years of postsecondary education and fellowships before they can start earning big bucks. MBAs and lawyers make a lot of money, especially if they go to a good school, but those programs cost $150k or more, plus the opportunity cost of missing out on salaries if you go full-time.

One of the most efficient paths is to obtain a bachelor’s degree in a technical field such as engineering (or an accelerated 5-year master’s degree), and then pursue a graduate degree or MBA part-time while working. You get to start earning money sooner and have less college debt, but you can still advance to management or project leadership later.

Make money on the side using side hustles

Do you have a talent or a hobby? If that’s the case, you might be able to perform it as a side job and earn an extra $5k-$50k or more to supplement your day job and boost your overall income.

Assume someone earns $40k per year after taxes and has $30k in annual costs. This leaves her with only $10,000 each year to save, invest, and pay down her debts.

However, if she can make just $5k in after-tax side income while keeping her personal costs the same, her total income will only grow by 12.5 percent (from $40k to $45k), but her savings rate will improve by 50 percent (from $10k to $15k)!

After adjusting for inflation, if you save an extra $5k each year and invest it at just 7% per year, you’ll have an extra $100k in your portfolio after 15 years.

If you’re more ambitious, and you can find out how to make an extra $20k each year after taxes and invest it at an annual rate of 8%, you’ll have $430,000 in 15 years. Inflation-adjusted, once again.

Small or larger side gigs can propel you into the top 5% of the population in terms of wealth over time.

Internet side hustles:

- Writing or editing as a freelancer

- Web design or coding as a freelancer

- Translation on a freelance basis

- As a virtual assistant, you can assist in a variety of ways.

- Coaching, consulting, tutoring, marketing, copywriting, and other services are available.

Offline side hustles:

- Work as an adjunct professor at a local college part-time.

- Become a part-time yoga or fitness instructor.

- Work as a freelance property manager or a handyman.

- Working as a part-time private chef

- Tax preparation, bookkeeping, child or pet care, tutoring, and other services are available.

Some of these you may get started with right away, while others will require time and money for training and certification.

Start a full-time or part-time business

The fact that successful entrepreneurship meets both parts of wealth building: a high income and a high rate of return on your collected wealth, explains why so many billionaires are firm founders.

Although just a small number of people will create the next Facebook, it does not have to be glamorous. If you know a trade, such as plumbing or construction, you can eventually start and develop your own contracting business.

You may eventually open your own place, hire people, and expand beyond your own reach if you can provide a service, such as marketing, consultancy, or fitness teaching. If you know how to coach something successfully, you might be able to transform it into a digital course and market it to a larger audience.

How to Get a High Rate of Return on Your Savings

Getting a high rate of return on your savings is important if you want to grow your wealth over time. There are a few different ways to do this, but some methods are better than others. In this blog post, we’ll explore some of the best ways to get a high rate of return on your savings.

To get a high rate of return on your money, you usually have to take on more risk, more volatility, or less liquidity.

Here’s a quick rundown on how to hit your desired rate of return. For best diversification, you’ll usually want a mix of multiple of these asset classes:

How to generate a yearly yield of 0-3 percent:

- Treasuries

- Bonds issued by corporations

- Bonds issued by municipalities

- Accounts of savings

Savings accounts and treasury bonds used to provide acceptable conservative returns, but not anymore.

Currently, investment-grade bonds offer only about 2% yearly yields.

The Federal Reserve has substantially decreased interest rates over the last few decades, notably during the last recession, which has resulted in a long-term fall in fixed-income returns:

The federal funds rate, which is the rate at which banks can borrow from one another over night, is used to calculate interest rates for savings accounts, bonds, mortgages, loans, and other types of debt.

Bonds will continue to be underwhelming investments in terms of risk/reward ratio as long as interest rates remain historically low. Bonds will become more valuable again if the federal funds rate rises a couple full percentage points, to around 2%, and they begin to return much more than inflation.

Bonds and savings accounts have their place in a conservative portfolio, but they won’t help you develop a lot of money in the long run.

How to generate 3–8% annual growth:

- Stock with a higher priority

- Peer-to-peer lending is a type of lending where people lend to each other

- Index funds are a type of mutual fund that invests in

Bonds used to provide returns in this range, but that is no longer the case.

Because the market currently has a high cyclically-adjusted price-to-earnings ratio, US equities returns from index funds and ETFs are projected to be lower over the next 10-20 years than they have been historically, as detailed in this article. (To put it another way, it’s overrated.) It would be reasonable to expect a return of 4-8 percent on the low end.

How to generate an annual yield of 8-12 percent:

The S&P 500’s historical rate of return has been in this range. Over the next decade or two, it’s unlikely to be as good.

Smart investing techniques may be able to produce returns in this range in the future, but it will be challenging. I feel the following are the most likely paths to achieving this level in the future:

- Dividend equities with high yields, low payout ratios, and a track record of sustained yearly dividend increases.

- Emerging markets and other international equities or exchange-traded funds (ETFs) are trading at bargain prices.

- Master Limited Partnerships and Real Estate Investment Trusts of Superior Quality

- Even in inflated markets, cash-secured puts and covered calls are used in investment strategies that provide strong returns.

- Certain alternative investments, such as Fundrise, offer good returns in exchange for a lesser level of liquidity.

M1 Finance, in my opinion, is the greatest investment platform for the majority of people. It is completely free of commissions and fees, and it enables for automatic investing in individual stocks and ETFs, as well as simple rebalancing.

How to generate 12-15 percent annual growth:

- Private equity in the top quartile

- Investing in real estate directly

Because private equity managers may genuinely modify and enhance the firms they acquire, and they often invest for years to achieve the transformations they set out to achieve, returns in this range are common.

If you have several million dollars on hand, investing in a respected private equity fund could be a good idea. Your gains may be rather large in exchange for a lack of liquidity.

Brookfield Business Partners, for example, is a publicly traded private equity vehicle. They accomplish the same thing as private equity funds (purchasing struggling businesses, converting them to be more profitable, and then selling or continuing to hold them, or strategically lending money to them), but the fund’s ownership is broken up and sold on a stock exchange.

However, no private equity fund can guarantee that it will achieve the same achievements in the coming decades as it has in the past. It’s also difficult to know what percentage of private equity funds succeed vs. those that fail because tracking private equity returns as a group hasn’t been very transparent.

Private real estate investing that is highly successful and makes extensive use of mortgage leverage has a good probability of hitting this range.

How to increase annual production by 15% or more:

- Invest like a world-class investor.

- Create a successful company.

Long-term returns in this range have been obtained by history’s top investors. Top hedge funds, top private equity funds, billionaire investors, and so on are all included. The majority of people never get near this high in the stock market.

Since 1965, Warren Buffett’s company Berkshire Hathaway has raised its per-share book value by an average of over 19 percent every year. It’s worth noting, though, that he achieved this return through financial leverage.

Seth Klarman’s Baupost Group hedge fund has similarly generated annual returns of more than 15% for the past three and a half decades.

From 1977 through 1990, Peter Lynch grew the Magellan Fund at a compounded annual rate of return of 29%.

Starting your own firm is a better way to achieve returns in this area. Although your chances of becoming a world-class investor are slim, you do have a good possibility of starting a highly profitable little business.

Returns on equity of more than 15% per year are common in successful small and large enterprises. In the early stages of a small and highly scalable business, such as software or services, return on equity might surpass 30% or more.

Examples of Wealth-Building

Wealth-building is a process of accumulating assets over time that can generate income or be sold for a profit. While there are many different ways to build wealth, some common examples include investing in stocks, bonds, real estate, and businesses.

Building wealth requires patience and discipline, but the rewards can be significant. Those who are successful in wealth-building often enjoy greater financial security, independence, and choices in their lives.

If you’re interested in building wealth, there are a number of strategies you can consider. In this blog post, we’ll discuss some of the

One of the most intriguing aspects of my research has been the language people use when discussing wealth creation.

When compared to “how to develop money” or “how to become wealthy,” for example, much more individuals search Google for variations of “how to get rich.” You’d think they’d be similar, but most people say it in the first way.

That, I believe, is due to the thinking of many people. “Getting rich” connotes a short-term goal, but “creating wealth” connotes a long-term goal earned via effort, sweat, and tears.

Building long-term wealth, in reality, takes time. You can speed up the process and accumulate wealth quickly in a variety of methods, but it’s always important to keep a long-term perspective. People who generate quick money and become wealthy quickly frequently lose it as quickly as they make it.

For example, if you create an internet business and make a lot of money, then spend it on sports cars and other devices, you can find yourself suddenly screwed if something in the market changes, such as your Google traffic or advertising rates, or whatever.

The trick, no matter how much money you make, is to put it into safe assets like index funds, dividend-paying companies, cash-producing real estate, and so on.

Even if you don’t make a lot of money, you can accumulate significant wealth over time and become wealthy. This section will show you how to generate wealth in a variety of methods, both quickly and slowly, modestly and aggressively.

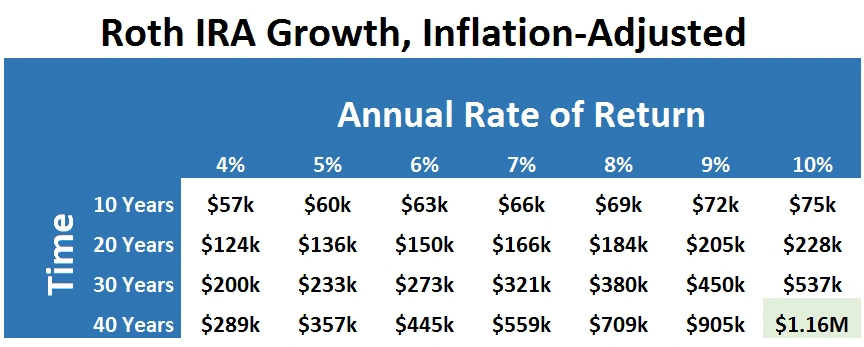

Roth IRA example:

For persons under the age of 50, the current Roth IRA contribution limit is $6,000 per year. You get to put in after-tax money, and it’s never taxed again after that. You won’t be able to use this investment vehicle if you earn more than $122,000 as a single filer or $193,000 as a married couple.

What kind of return can you expect from an account like this?

Based on present high market values, John Bogle, the founder of Vanguard and inventor of the index fund, expects that stocks will return around 5% per year over the next decade. Over the next 20 years, McKinsey & Company predicts 4-6 percent annual market gains.

It’s hard to predict how quickly your equity investments will increase, but Dr. Robert Shiller’s 130-year historical price-to-earnings data backs up their predictions: high market values, like today’s, have always resulted in dismal forward-returns over the following 10-20 years.

So, let’s say you save the maximum $6,000 per year, and you keep saving that amount (adjusted for inflation) for the following few decades. The table below displays your wealth growth depending on various rates of return across various time periods:

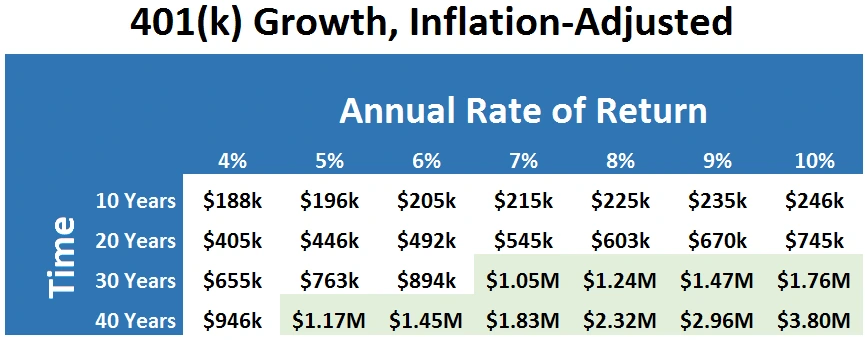

The following is an example of a 401(k) and a Thrift Savings Plan (TSP):

These sorts of retirement plans allow you to invest up to $19,000 each year and maybe receive an employer match, with no income restrictions. Private firms generally use the 401(k), whereas government civilian and military personnel use the TSP as their primary investment vehicle.

The money you put in is tax-free, but you will be taxed when you withdraw it. (Though Roth 401(k)s and Roth TSPs are now available.)

The table below depicts the accumulation of wealth in your 401(k) or TSP over time at various rates of return, assuming you contribute the maximum amount with no matching contributions.

Even better if your employer contributes another 5% of your pay. That’s what the TSP offers, whereas 401(k) contribution matching varies per company.

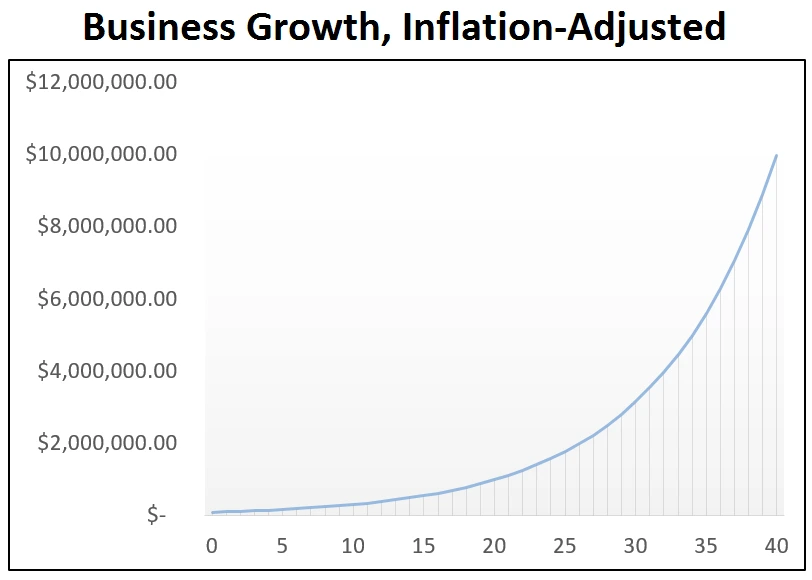

An example of entrepreneurship is:

Let’s say you took $100,000 and invested it in your own firm, then managed to raise the equity of that business by 15% every year.

This graph depicts the inflation-adjusted worth of that business equity over time, demonstrating how multimillionaires become wealthy:

In actuality, you’d be paid a salary by that company at some time, which you could use to invest. You may also have company partners or early investors who have an impact on your ownership share.

However, entrepreneurship in some form is the most reliable method to achieve very high rates of return over extended periods of time, even if it is somewhat risky.

You May Also Like

Five Quick Wealth-Building Strategies

When it comes to building wealth, there’s a lot to learn. There are so many ways to make money, and so many different ways to save money. It can be hard to know where to begin. This article will show you some of my favorite ways to build wealth quickly.

The most difficult element of accumulating wealth is getting started. It gets easier after that as you build on your first momentum.

There’s a lot of information to take in at first, and there are a lot of various paths you may choose.

So, here’s the broad order of what to do first.

You’ll probably want to do some of them at the same time, which is fantastic. However, certain things should be deferred for later (such as investing), while others must be completed immediately (like paying off debt).

So here we go:

Now is the time to pay off high-interest debt

The past few months have been tumultuous for our country and our economy. The uncertainty in our country has led to a sharp decline in the stock market and a decrease in the value of the dollar. This has caused a lot of financial stress for a lot of people, especially those with high-interest debt. High-interest debt is debt that requires a large amount of interest to be repaid each month.

Credit card debt with high interest rates, unsecured loans, and virtually anything with an annual interest rate of more than 6% must be paid off right now.

Keeping some low-interest debt, such as a mortgage or college debt, can be beneficial because it allows you to invest in higher-yielding assets and begin accumulating wealth. However, those other high-interest loans must be paid off, so put money into them aggressively until they’re paid off.

If you have high-interest debt, treat it as an emergency and work extra hours or do whatever it takes to get it paid off this year. You’ll be glad you did it later.

This can also help you improve your credit score, which will save you money on interest payments and provide you with access to great rewards cards.

Spending on items that don’t serve you should be slashed mercilessly

The time has come for a serious re-think on how we spend our money. As a society, we have reached a point where we have become so focused on getting the biggest, fanciest thing our money can buy that we have forgotten the most basic of principles: what do our purchases actually serve us and how can we get that without paying the price for the bells and whistles? I will not deny that some of our purchases are frivolous, but to say that all of them are is absurd. We live in a world of excess, where people are willing to pay a premium for a product that is essentially the same as another product that is less expensive.

This is where I stand out from the crowd.

I dislike frugality and am not a frugal person. Instead, I advocate minimalism.

I spend a lot of money on high-quality, ethical, and sustainable food, and I don’t mind paying a premium for it. I go to different continents and stay in five-star hotels, and those are some of the most memorable events of my life.

But what about my car? I don’t give a damn about it as long as it’s dependable and secure. It’s cheap, and I’ll use it up before investing in another. I don’t have access to cable television. My flat is so little that my landlord once inquired if I truly live there, assuming I’m always traveling for work or something.

That’s how I prefer it since it allows me to concentrate.

I’ve discovered that having a love for something and minimizing costs are inextricably linked. Naturally, the first leads to the second.

Being economical and squeezing pennies can be tedious and frustrating if you just think about what you don’t have. However, reducing your stuff, traveling lightly through life, and focusing your time and energy on tasks that you enjoy (and that often generate money) may be extremely rewarding.

The major reason I avoid purchasing items is because I imagine how much time and energy they would consume, as well as how distracting they will be. Clutter makes me sick.

Although everyone is different, this method seems to work for a lot of peop. Spend freely on the things you enjoy, and slash what you don’t.

Create a cash reserve in the event of a financial emergency

As a preventative measure against financial hardship, establishing an emergency fund is a great way to ensure that you can weather financial storms. people tell you to save 10% of your income, but you will want to start much stronger. more realistically, you should have at least three to six months of living expenses saved up in the event of an emergency.

Establish an emergency fund for liquidity. The fund will help pay for unexpected expenses such as medical bills, or to address any potential unforeseen financial emergency that may arise for your family. This emergency fund should include at least 20% of your gross annual income and can be set aside in a savings account, money market, or retirement savings account.

You’ll need some extra cash about the same time you’re paying down your debt. It’s not a lot, but it’s a start.

The percentage of folks who wouldn’t be able to come up with $500 if they had to is worrying. There are numerous things that can go wrong, like as your car breaking down, a medical emergency, a family death, or a variety of other things, and you need liquidity to deal with them without resorting to credit cards.

Look for new sources of income

In the end, high-paying jobs tend to pay high salaries, especially when compared to the average person, who must work the “grunt” jobs. If you’re trying to increase your income, seek out higher-paying jobs that pay well. You can find a job anywhere, but some areas pay better than others, and some jobs pay more in some states than others.

There are three main approaches to this:

- Concentrate on your career and get a big salary for your knowledge.

- Work a solid career while also pursuing a lucrative side venture.

- Become a full-fledged entrepreneur and create a larger company.

If you take the first path, you’ll likely invest time and money in education and ongoing training, strive to be a top performer at work, and maximize your return through good negotiating. Doctors, lawyers, lead engineers and scientists, upper-level management, and other professionals follow this path. You can have a side hustle as well, but it will be difficult because your profession requires so much concentration.

If you take the second path, your employment may not be as glamorous, and you may not have a college diploma, but you will have more free time to establish additional revenue streams on the side. There are various methods to create money on the side to help hasten the process, whether it’s freelancing, tutoring, dog-sitting, or anything.

The third option, which is the most uncommon, entails quitting your day job and focusing only on starting and building a business. The payout might be enormous, but it could also fail, resulting in a waste of time and money.

Choosing one of these three options is a proven strategy to build wealth over time. Working a normal job, not having a side hustle, and not running a business would be the lone mistake. Millionaires do not put in 40-hour work weeks.

Invest your money as quickly as you can

When it comes to saving, people often think of the now rather than the future. But the best way to build wealth is to have a savings habit that leads to investing when you have the money. Even a small amount of money can be invested, which can compound into even more money over time. It’s better to invest your money now than to save it without any action.

When it comes to finances, sometimes the best decision is the one that requires the least amount of thinking. On the occasion that you find yourself in that situation, there is no better way to handle your money than to just invest your money as soon as you get it. This will help you build up your emergency fund, which will help you feel more secure regardless of the economy. It will also help you build up your retirement savings, which will help you feel more secure regardless of the economy.

The first objective for each paycheck (or each month if you don’t have regular income) should be to invest a large portion of it before it becomes spendable. This is what it means to pay yourself first.

- If you have a 401(k), contribute at least 5% of each paycheck automatically.

- If you have a Roth IRA, make sure you contribute the maximum amount each year. If possible, set up automatic withdrawals from your bank account.

- Increase your 401(k) contributions or begin putting money into taxed accounts.

- You can start aggressively compounding your wealth by saving at least 20% of your income each year.

You’ll have greater freedom to spend what’s left after much of this is automatic and you’re putting a lot of money into your accounts every month.

When you first start investing, you should put as much money as you can into your investments as soon as you receive it. This will give you a better return than saving the money and investing it when you have more money. You can also use this money to make investments of your own. This will help you grow your money faster and over a longer period of time than if you save the money and invest later.

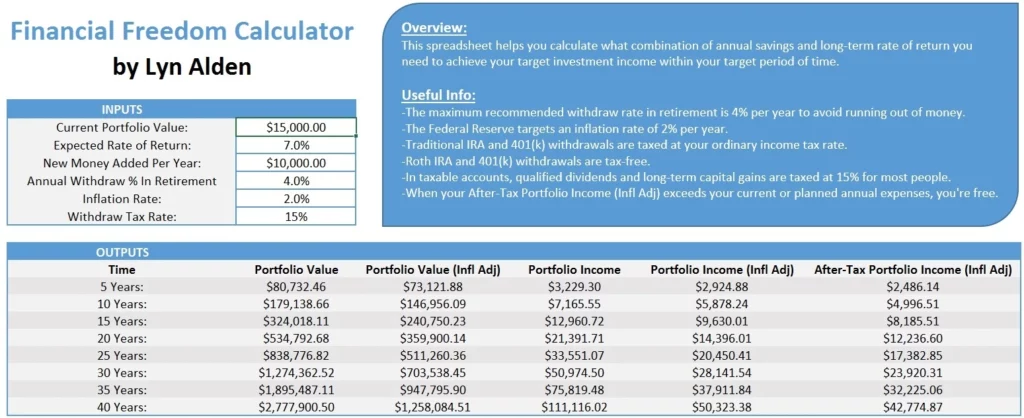

Financial Freedom Calculator

The Financial Freedom Survey is a FREE online tool that helps you establish your financial freedom. It is designed to teach you how to build wealth using a step-by-step method that combines investing, saving, and a frugal lifestyle.

Here’s a free Excel spreadsheet tool that will help you calculate your own path to financial independence:

Financial Freedom Calculator Download

The following variables can be changed using that tool:

- Portfolio value at the moment

- Savings amount per year

- Long-term expected rate of return Long-term expected inflation rate

- For calculating passive investment income, use the withdrawal rate.

- Effective tax rate on withdrawals from your investment

You can then construct a game strategy based on how different scenarios play out with a high degree of accuracy.

I looked at a few different calculators and concluded we needed one that was inflation-adjusted, took taxes into account, was super-easy to use, and gave you enough freedom to chart your own course.

Wealth-Tracking

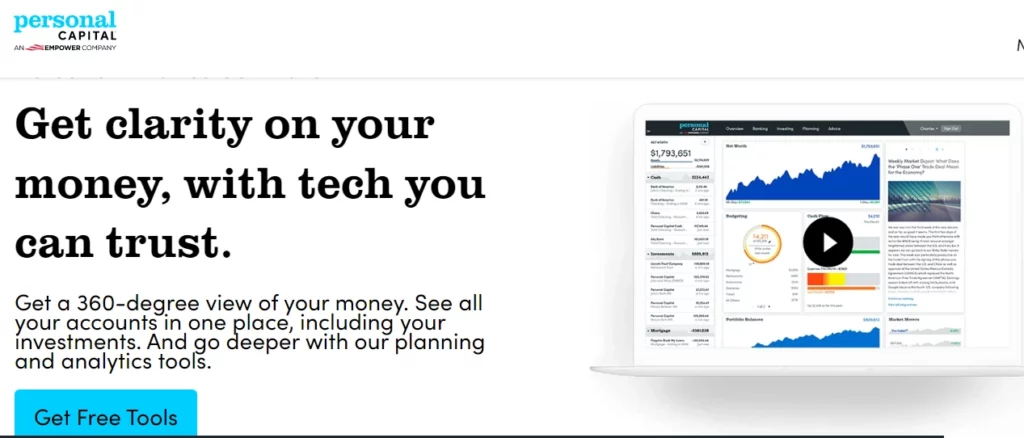

Personal Capital is another excellent free resource.

You may see a detailed overview of your financial condition with Personal Capital:

It contains the following items:

- To see where you stand, a graph of your net worth over time.

- A complete overview of where all of your monthly spending go.

- A fee-scanner to detect hidden costs that you may not be aware of.

- A retirement planner that can help you determine if you’re on track for retirement.

summary

You can use a framework like this to map out what your target wealth level is, and how to get there. There are plenty of ways that you can achieve any realistic wealth target and passive investment income that you have in mind, as long as you plan and act accordingly.

There are many different ways to build wealth, but most people accumulate it slowly over time by saving and investing. You can inherit money, win the lottery, or get lucky in business. It’s not easy to amass a fortune quickly, but it’s definitely possible.

Find Us on Socials